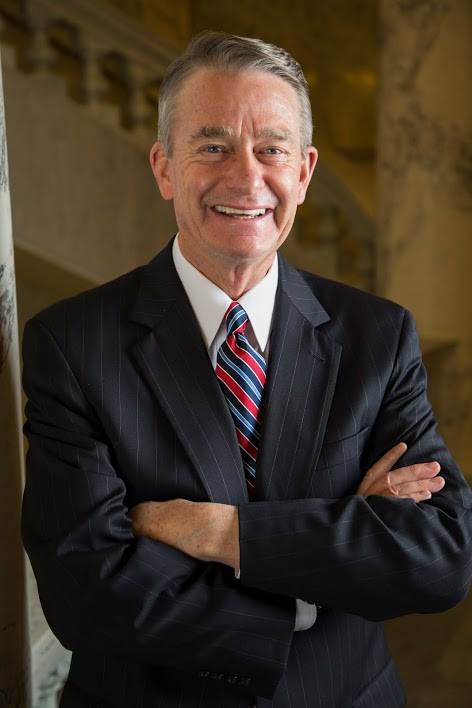

Governor orchestrates inflation relief 10 weeks before Nov. election

By Eric Valentine

With prices at historic highs and the Nov. 8 general election—in which all 105 seats in the Idaho State Legislature are up for grabs—just 10 weeks away, Gov. Brad Little called for a special legislative session to pass a bill that responds to the harm inflation is inflicting on Idaho taxpayers and the education system. It was only the fifth such session in the last 22 years.

The bill, which comes on the heels of the federal government’s Inflation Relief Act, provides a one-time tax rebate of $500 million to help Idahoans struggling with inflation and property tax bills. The rebate is the greater of 10% of tax amounts paid in 2020 or $600 per joint filer ($300 for individual filers). The bill overwhelmingly passed both the Idaho House of Representatives and the Idaho Senate. Gov. Little signed the bill into law at 6:27 p.m. last Friday.

Specifically, the bill:

Consolidates the income tax brackets to a flat tax at 5.8% for both individuals and corporations, providing a tax cut for all Idaho income earners and enhancing the state’s business competitiveness.

Exempts the first $2,500 from taxation for single filers or $5,000 for joint filers.

Provides $410 million of annual funding directly from the state’s sales tax to the public school income fund and in-demand careers fund.

Gov. Little was not shy with words over the success of the legislative accomplishment. He said the following:

“The successful extraordinary session demonstrates government working for the people. I am proud of my legislative partners for confronting the substantial impacts of inflation head on by putting our record budget surplus back in the pockets of Idahoans while responsibly funding education at historic levels to ensure we are meeting our constitutional and moral obligation to Idaho students and families both in the short-term and the long-term. Returning the people’s money is the right thing to do, and the education investments support families, help us keep up with growth, enhance our quality of life, and prepare a workforce to meet the changing needs of employers.

“The people of Idaho expect the executive and legislative branches to work together to move our state forward. I deeply appreciate my partners in the Legislature for continuing to show the rest of the country how Idaho does it right—we work together to promote a business-friendly tax and regulatory environment, live within our means, pay off our debt, save for a rainy day, routinely cut taxes, and make investments where they count.

“Idaho is an incredible success story, and I am proud of what we’ve accomplished for the people we serve!”

Timing Is Everything

Gov. Little is now holding a series of media events across the state to celebrate the legislation. It’s less than two months from when voters across the state will say whether his authority should be weakened by Senate Joint Resolution 102, which would allow the Idaho Legislature to call itself back into session without the governor’s approval. A simple majority of votes would approve Senate Joint Resolution 102 and make it easier for the legislature to do things like override mask mandates.

New budget projections show the state’s budget surplus will hit a record-breaking $2 billion soon. So of special note is that the $500 million is an immediate one-time income tax relief. Another $150 million in tax cuts will be ongoing by establishing a new, lower flat tax.

The $410 million in ongoing support for Idaho education is a new spending record for Idaho. It’s also a potential roadblock to the Quality Education Act education funding initiative. The Quality Education Act, which the political activist group Reclaim Idaho got onto the Nov. 8 ballot, will generate $330 million per year in a new fund for public schools by raising the corporate income tax to 8% and creating a new top income tax bracket of nearly 11% for individuals who make more than $250,000 per year.

Gov. Little’s aides have told other media outlets that the special session bill would repeal the Quality Education Act because the Quality Education Act would take effect Jan. 1. Little’s special session bill was written to take effect Jan. 3. Reclaim Idaho has said questions remain whether that’s correct.