Valley homeowner wallets get walloped by 36% spike in property value

By Eric Valentine

Attention working class folks!

Have you seen your most recent property tax bill? They were sent out late last month by the Blaine County Assessor, and compiled with the current price of a tank of gas, you may want to think twice about that bag of avocados on your shopping list. Who do you think you are? Bezos? But, hey, at least you’re rich on paper and since you can pay property tax with a credit card, don’t stress too much about being short on cash. Maybe your bank will even let you turn your home’s equity into one big credit card (it’s called a HELOC—home equity line of credit). Be thankful that in this Valley you have a place to live.

Sometimes making light of a heavy situation brings clarity. Yet thanks to a pandemic-immune (and/or pandemic-caused) real estate boom and the way Idaho calculates property tax, folks who have long owned their home here have a not-so-funny burden they are obligated to pay. In some cases, homeowners are seeing their property tax bills double and nearly triple. Take for example, Robert Bergdahl (yes, Bowe’s dad).

Bergdahl, who has lived out Croy Canyon for 37 years, addressed the Blaine County commissioners recently and told them about his family’s property tax burden. Specifically, he noted how in 2022 his property tax increased 250%, why in his opinion the method of setting property tax rates is morally and economically wrong, and how before 2016 it never used to be this way.

So What Changed?

Staryear: 2016. The Idaho Legislature—let’s give them the benefit of the doubt—sees a win-win situation for everybody. Real estate prices are going up but not blasting toward space and although the economy has been long recovering, businesses can always use a break. So the Gem State’s braintrust passed a bill that became law and changed the way the so-called homeowner’s exemption worked.

Homeowners used to get an exemption on 50% of their home value. For instance, on a home worth $200,000 (yes, they used to exist), a homeowner would only pay taxes on $100,000 of the value. In the event property values rose across the state, the exemption would also rise (yes, up to a certain point). The 2016 law made one very impactful change. It capped the exemption at $100,000.

So What?

The law’s impact might be insignificant to homeowners during a normal real estate market. But in a booming market, homeowners get slammed. And it’s a twofold slam. Part 1? They pay a higher dollar amount personally. Part 2? They pay more collectively. That is, in some parts of the state, homeowners and businesses used to evenly split the tax revenue burden, roughly 50-50. Today, homeowners are taking on more than two-thirds of the burden.

Some stakeholders in all this might point out that taxes on real estate in Idaho are relatively low in comparison with the rest of the country. According to SmartAsset Advisors, LLC, the typical homeowner in the Gem State pays $1,616 annually in property taxes, around $1,000 less than the national average. But, Idahoans also have lower income levels than a lot of other states, too. According to U.S. Census Bureau data, Idahoans have the 15th highest property tax burden based on income.

Now What?

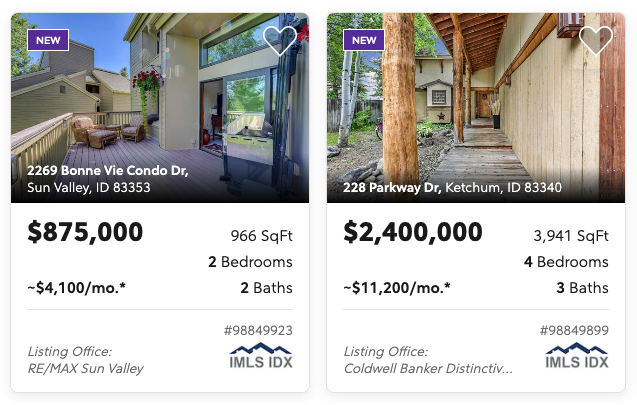

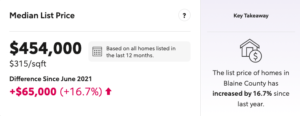

The real estate market here is still strong. MLS data shows that between May 2022 and June 2022, listing prices of homes in the Blaine County real estate market have seen the following price changes:

1-bedroom properties increased by 0.5%

2-bedroom properties prices increased by 9.1%

3-bedroom properties prices increased by 10.7%

4-bedroom properties prices increased by 30.1%

5-bedroom properties have not changed

Translation: the problem isn’t going away soon. In an email he sent to Wood River Weekly, Bergdahl had some ideas for a possible solution. What follows is a paraphrased summary of those ideas:

Re-establish the pre-2016 homeowner’s exemption or improve it.

Challenge the formulation of property tax based on “market” value since taxation fixed to something as volatile, subjective and manipulated as the real estate market is untenable.

Work to place the tax burden on the “people” (i.e., Citizens United Decision: corporations are people) who profit the most.

Re-implement the Glass-Steagall Act of 1932, separating commercial banking from investment banking.

Tax ‘Wall Street’ for seeking maximum rates of return on investment.

Institute public banking. No longer allow states and municipalities to borrow from commercial banking.

One additional idea: In November, vote.