BY KIKI TIDWELL

Blaine County property taxpayers, hold on to your hats; you may be paying significant increases in property tax amounts in the next few years. It is my understanding that there have been County Commissioner meetings with Idaho Power to discuss financing the undergrounding expense of a new transmission line. But the public has not been allowed to attend these sessions, so we can only make guesses at this time what the proposals are.

Blaine County property taxpayers, hold on to your hats; you may be paying significant increases in property tax amounts in the next few years. It is my understanding that there have been County Commissioner meetings with Idaho Power to discuss financing the undergrounding expense of a new transmission line. But the public has not been allowed to attend these sessions, so we can only make guesses at this time what the proposals are.

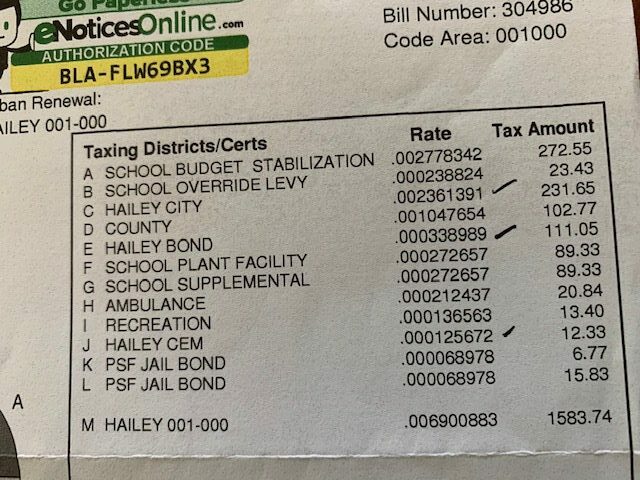

Idaho Power has told us that undergrounding a line from Hailey to Ketchum may cost somewhere between $30-$35 million. The Blaine County property tax total levy was $11,131,873 last year, and the county is currently paying about $555,000 per year on a $6,120,000 General Obligation bond it issued in 2015, so a $35 million bond would be roughly 5-6 times this annual expense for county taxpayers, or property taxes going up by about 25 percent to pay for this new bond. And what do taxpayers get for that?

If we were taxpayers in any other state than Idaho, we might be getting up-to-date technology that is truly resilient and can really provide backup power if the lines fail into Hailey again. Other states are rapidly installing batteries and solar farms instead of transmission lines.

“Cumulative distributed energy resource capacity in the United States will reach 397 gigawatts by 2025, according to a new Wood Mackenzie report. …Cumulative U.S. DER investments will eclipse $80.6 billion between 2020 and 2026.” 1

Other states are also recognizing the vital role that building renewable energy projects in their states can provide in aiding in economic recovery. “Minnesota Public Utilities Commission COVID-19 Dockets. Previously, the Minnesota Public Utilities Commission (the “Commission”) initiated its own investigation into the impacts of the COVID-19 pandemic on utility service… At the same hearing, the Commission also responded to a policy memorandum circulated by Commissioner Sullivan. In the memorandum, Commissioner Sullivan requested that the Commission open a new docket to explore various ways utilities may “accelerate investments” and aid recovery from the COVID-19 pandemic.” 2

For our cities that have lost LOT revenue from loss of tourism business, a project sited within the city can potentially add to the property tax base revenues. The state statute limits them to 3 percent increases on the prior tax levy, but also allows base increases by the value of new construction. Alternatively, at this time of cost-cutting by cities, the large electrical costs of running a city sewer plant could be significantly reduced if the city owns its own solar plant next to the sewer plant, and there are options right now for cities to build these solar plants with no money down.

Increased revenues, decreased expenses, economic recovery, and secure electricity for our residents come not from spending $35 million on a 1950’s-technology transmission line, but building our own renewable energy next to where we use it.

1 https://www.greentechmedia.com/articles/read/coming-wave-of-der-investments-in-us

2 Stoel Rives EnergyRegulatoryUpdate_June222020.pdf