BY ANNA & MICHELLE

The TCJA of 2019 dramatically increased the standard deduction so that many homeowners benefit from taking that rather than itemizing their deductions.Taking the standard deduction may result in a larger deduction even if you have no expenses that qualify for claiming itemized deductions.

Another thing reinforcing taking the standard deduction was low rates at the time and the interest plus property taxes were less than the standard deduction.

In 2022, mortgage rates more than doubled, so anyone who purchased a home or refinanced at the higher rates might benefit from itemizing rather than taking the standard deduction. The takeaway in this article is to compare both methods each year to see which way provides the larger deduction.

For 2022, the standard deduction for married couples filing jointly is $25,900, for single filers and married individuals filing separately is $12,950, and for heads of households is $19,400. There are increased amounts for seniors over 65.

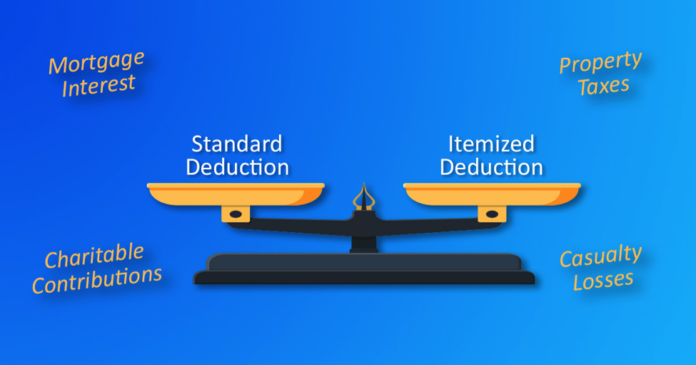

Mortgage interest, points paid to purchase a home (paid by seller or buyer), and property taxes are deductible on Schedule A. Other items allowed as deductions are charitable contributions, medical expenses in excess of 7.5% of taxpayers’ adjusted gross income, and casualty and theft losses from a federally declared disaster.

In 2019, IRS reported that 89.5% of people took the standard deduction, which is easier to file, doesn’t require receipts, and may yield a higher deduction than itemizing, but the only way to be sure is to compare both ways.

For more information, download Publication 529 or contact your tax professional. Download our Homeowners Tax Guide for more information on homeowner taxes.