BY ANNA & MICHELLE

Inflation devalues the purchasing power of money and the interest earned on savings is almost always less than inflation. Tangible assets like your home consistently become more valuable over time. In inflationary periods, a home is a good investment and a hedge against inflation.

Borrowing money at fixed rates during times of inflation can be very advantageous…like buying a home. The rate stays the same over the term of the mortgage and so does the payment instead of going up at the rate of inflation.

In September 2022, rents rose by 7.2% according to NAR Chief Economist, Lawrence Yun and “rents are accelerating to higher figures with each passing month.” The annualized rate for this year is 10.6%. Buying a home allows you to avoid rent increases while enjoying property appreciation.

The housing shortage that is fueling the price appreciation, as well as increases in rent, is something that has existed for over ten years, yet American home building has not kept pace with population growth.

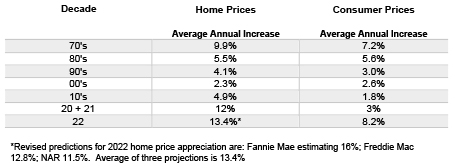

When you are repaying the mortgage, you are using dollars that are worth less and less due to inflation. Home Price Appreciation has been close or beaten inflation in each of the past five decades.

The funds for the down payment and closing costs that are sitting idle in a bank, while an otherwise qualified buyer waits to see what happens in the market, are having their value eroded by inflation. At the current rate of inflation, $48,000 would be worth $39,073 in three years. In seven years, it would be worth $29,697.

A 90% mortgage at 6.3% for 30-years on a $400,000 home that appreciates at 4% a year will have an estimated equity of $202,000 in seven years due to appreciation and amortization. That is a 22.8% annual rate of return on the down payment plus $8,000 closing costs. That is a significant hedge against a current inflation of 7.1%.

The borrowed funds in the mortgage produce leverage for the homeowner to enjoy the benefits as the value of the home goes up while the unpaid balance goes down with each payment made due to amortization.

Every day, a renter, who is otherwise qualified to purchase a home, is faced with a decision to continue renting or buy a home. Renters will ultimately be facing an increase in their rent, feeling an erosion of the purchasing power of their funds, and experiencing an opportunity cost by not benefitting from the appreciation and amortization benefits of buying a home.

Let’s connect and talk about what opportunities are available now and options that could benefit you, even considering the volatile economic atmosphere we’re all facing.