BY ANNA & MICHELL

Social Security was established on August 14, 1935, to take care of the country’s elderly in their retirement years. Today, about 65 million, or one-sixth of Americans, collect benefits and the average monthly retirement amount received in January 2022 was $1,614 per month or about $19,370 per year.

This annual Social Security benefit exceeds the 2022 federal poverty level of $13,590 for individuals and $18, 310 for a family of two, but from a practical level, it is nowhere near enough to be comfortable in your “Golden Years.”

Every adult in the workforce can go to SSA.gov to find out what to expect to receive based on their planned retirement age. Since it probably won’t be the amount you need to retire comfortably, at least you’ll know how short you’ll be so that you can devise an investment plan.

There’s a quick formula to estimate the investable assets needed by retirement to generate a certain income. The target annual income is divided by a safe, conservative yield to determine the investable assets needed. A person wanting $100,000 annual income generated from a 5% investment would need investable assets of $2 million. If a person had $500,000 now, they would need to accumulate $1.5 million more by the time they retire. A 50-year-old wanting to retire at 65 would need to save about $100,000 a year for 15 years.

If trying to save an extra $100,000 a year seems impossible, consider the leveraged growth available in rental real estate. The use of borrowed funds can contribute to the yield earned by the investment. By reinvesting the positive cash flows from the rental to retire the mortgage, the home could be paid for by retirement, providing more cash flow when it is needed the most.

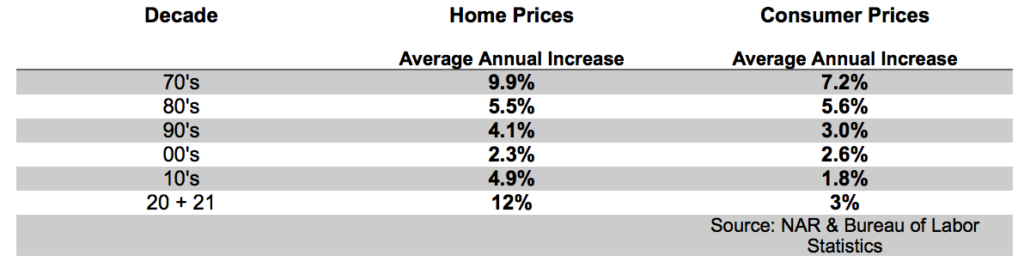

One of the bright spots in investments is rental real estate, which is also open to self-directed retirement savings. Single-family homes offer high loan-to-value mortgages at fixed interest for long terms on appreciating assets with tax advantages and reasonable control. Price appreciation alone has outpaced inflation for the last 50 years.

Many Americans have participated in Individual Retirement Accounts, SEPs, 401(k)s or other types of retirement that would supplement Social Security benefits. Many of these are invested in mutual funds, which have lost about 20% in value in 2022. With inflation at a 40-year high, many retirees and future retirees are concerned about their income from these investments.

Retirees want a safe and secure investment whose income will not be eroded by inflation. Single-family homes, in predominantly owner-occupied neighborhoods, meet those requirements. Home prices have experienced double-digit appreciation in the past two years and around 5% for the last five decades.

Increased mortgage rates coupled with rising home prices have sidelined many would-be purchasers who want to be in a home. Since they cannot buy at this time, the next best alternative is to rent a home. This has added to the increased demand for single-family homes in good neighborhoods, which has resulted in increased rents. While this isn’t good news for tenants, it is for investors.

Investing in rental real estate could be a way for you to increase your retirement income and grow your net worth while avoiding the volatility of the stock market. Current homeowners already are aware of the value of homes as well as the maintenance they require.

To get more information about single-family homes for rentals, download our Rental Income Properties guide. You can also schedule a time with me to get answers for any questions you may have and find out about what is available now.