Heavy snowfall in 2019 reins in more sales tax revenue for Ketchum, Sun Valley

By Eric Valentine

All those times your car got stuck in the snow this past winter, all the shoveling and snowblowing of walkways you had to do, it has a silver lining to it—at least as far as city budgets are concerned.

Sales tax receipts for both Sun Valley and Ketchum show an increase in revenue from last year, specifically for the month of March, shortly after near-record snowfalls dumped on those resort towns. In a valley that relies heavily on the so-called local option tax placed largely on tourism dollars, this is fondly welcomed news.

‘WONKY’ DETAIL ALERT: A local option tax (LOT) is a sales tax levied by a city. It is often used as a means of raising funds for specific local or area projects, such as improving area streets and roads, or refurbishing a community’s downtown area. Retail shops, lodging and liquor sales are industries that contribute to these revenues. Receipts totaled in, say, February, represent spending that occured in January.

Ketchum’s Coffers

From February 2019 through April 2019, Ketchum took in nearly $60,000 more in sales revenue when compared to 2018. Over the entire winter season (roughly December through March), the city took in just shy of $938,000. With the exception of January, each month from October 2018 through May 2019 saw an increase in sales tax revenue compared to its 2017-18 counterpart.

In late May, Ketchum announced a $771,000 budget shortfall due in large part to increased expenses, the city has said, in employee salaries and benefits as well as the cost of its Sustainability Advisory Committee—an effort that scrutinizes city projects to determine the most environment-friendly way to carry them out. So data about the historically high sales tax revenue comes at the right time.

Ketchum City Council will be meeting throughout this month to craft its next year’s budget. Typically, city budgets are adopted in August and implemented by September.

Sun Valley’s Pot O’ Gold

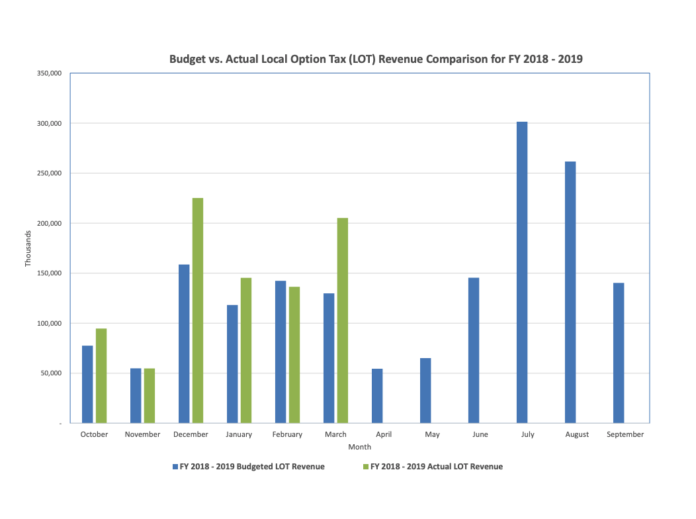

Month by month, Sun Valley’s LOT numbers were a little more mix and match. However, for March, there was a 43 percent increase in the sales tax. Specifically, March 2019 saw a revenue of $205,103—more than any prior year and more than double the totals from just five years ago. Lodging for 2018-19 saw a 79 percent spike compared to 2017-18.

Perhaps more important than dollar counting is how accurately a city predicts its revenue for each upcoming year. In a nutshell, cities want to be as spot on as possible, but if they’re wrong, they want to underestimate their revenue expectations. On this metric, Sun Valley is having a banner year. From October 2018 through March 2019, the city was rarely off by far. And when they were, their actuals trumped their expectations.

For instance, in December, Sun Valley took in roughly $225,000. They projected just around $160,000. In March, they took in north of $200,000. They projected south of $140,000.