For all of you looking for a way to help climate efforts, perhaps look at where you are investing; does your mutual fund or ETF currently have you invested in fracking and pipeline companies instead of wind farm companies? Have you thought about the downside risk that might be lurking in your investments? Type your fund in www.fossilfreefunds.org and find out; great listing and ranking of fossil-free funds, as well.

For all of you looking for a way to help climate efforts, perhaps look at where you are investing; does your mutual fund or ETF currently have you invested in fracking and pipeline companies instead of wind farm companies? Have you thought about the downside risk that might be lurking in your investments? Type your fund in www.fossilfreefunds.org and find out; great listing and ranking of fossil-free funds, as well.

Some Exxon investors particularly wish that they had invested somewhere else. A trial was started in New York City this past week in which the New York attorney general alleges that investors were misled by Exxon as to the risks and costs of climate change while Exxon maintained a separate set of books where the true costs were known to the company. “From 2010, Exxon told the public it had assigned a price to carbon to account for how government regulation would affect its business. However, it privately used a much lower figure, allowing it to make carbon-heavy investments such as in the tar sands of Alberta, Canada, that would appear much less profitable otherwise… ‘As a result of Exxon’s fraud, the company was exposed to far greater risk from climate-change regulations than investors were led to believe’”.1

Looking for where the puck is going in clean-tech-sector businesses?2 This past week the International Energy Agency published a report, Offshore Wind Outlook 2019, where their “detailed study of the world’s coastlines has found that offshore windfarms alone could provide more electricity than the world needs… If windfarms were built across all useable sites, which are no further than 37 miles off the coast, and where coastal waters are no deeper than 60 meters, they could generate 36,000 terawatts of power… The study predicts offshore wind generation will grow 15-fold to emerge as a $1 trillion industry in the next 20 years and will prove to be the next great energy revolution.”3

Apparently, offshore wind can provide more consistent generation with less intermittency. “Offshore wind output varies according to the strength of the wind, but its hourly variability is lower than that of solar PV. Offshore wind typically fluctuates within a narrower band, up to 20% from hour-to-hour, than is the case for solar PV, up to 40% from hour-to-hour… At these levels, offshore wind matches the capacity factors of efficient gas-fired power plants, coal-fired power plants in some regions, exceeds those of onshore wind and is about double those of solar PV”.4

Apparently, offshore wind can provide more consistent generation with less intermittency. “Offshore wind output varies according to the strength of the wind, but its hourly variability is lower than that of solar PV. Offshore wind typically fluctuates within a narrower band, up to 20% from hour-to-hour, than is the case for solar PV, up to 40% from hour-to-hour… At these levels, offshore wind matches the capacity factors of efficient gas-fired power plants, coal-fired power plants in some regions, exceeds those of onshore wind and is about double those of solar PV”.4

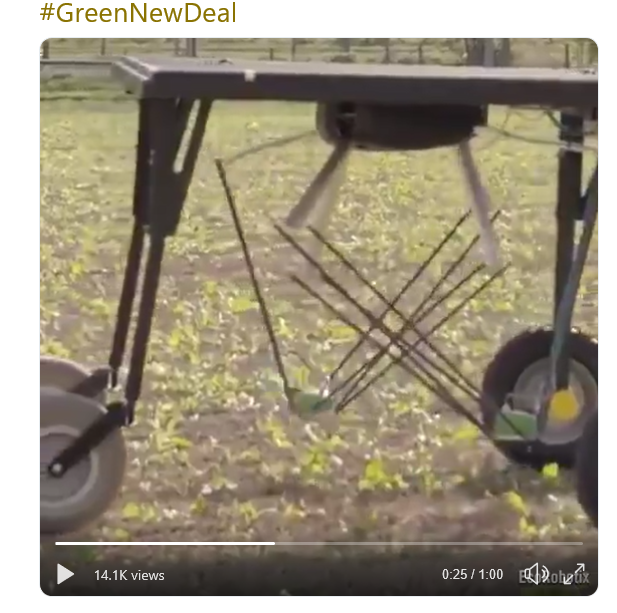

On another positive note, meet a weed-picking robot powered by solar panels that, in addition to direct weed picking, can really cut down on the amount of herbicides and pesticides sprayed with targeted micro doses. There is a great video of it in action at www.ecorobotix.com/en/. Given the news out of Parma, Idaho, where field workers fell sick after being sprayed by a crop duster, the faster we can switch to targeted micro doses, the better.5 The Idaho Statesman took the additional step of reprinting their article in Spanish. Here’s the link. www.idahostatesman.com/news/local/investigations/article236501373.html.

I would imagine that farms also would find considerable savings in using less product. It is often the case that ‘doing good’ for the planet and people enables investors to ‘do well’ financially.

1 www.theguardian.com/business/2019/oct/22/exxonmobil-trial-climate-crisis-allegations-misleading-investors-

2 I am not a financial advisor and this is not financial advice

3 www.theguardian.com/environment/2019/oct/24/offshore-windfarms-can-provide-more-electricity-than-the-world-needs

4 www.iea.org/offshorewind2019/

5 www.msn.com/en-us/news/us/farmworkers-fell-ill-after-alleged-pesticide-exposure-its-going-to-keep-happening/ar-AAJ4rBJ